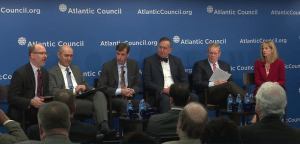

The Atlantic Council “The Space Race in Business” Panel, Nov. 18 in Washington, D.C. Left to right: Steven Grundman, Atlantic Council; Eric Thoemmes, VP, space and missile defense programs, Lockheed Martin; Clayton Mowry, president, Arianespace; Paul Domorski, CEO, Artel; Jay Gibson, CEO and president, XCOR; and Kay Sears, president, Intelsat General. Photo: Atlantic Council

[Via Satellite 11-19-2015] Business leaders across the satellite and space sector met in Washington, D.C. on Nov. 18 at the Atlantic Council’s “Space Race in Business Panel” to discuss how they plan to adapt for the evolving provision of services that require the space segment to acclimate to a new frontier. The panelists, including senior executives from Arianespace, Intelsat and Lockheed Martin, among others, discussed how their companies are working toward the shorter launch timelines and more affordable price points necessary to compete with “NewSpace” companies and introduce new systems and solutions in both commercial and government markets.

“We have to adapt to change,” said Clayton Mowry, president of Arianespace. “When we started in this business we were competing against the space shuttle and then we evolved to compete against Atlas, Delta, Proton, Zenit, Falcon, all these new systems that have come on the market place … It’s not the strongest or the most intelligent that survive but those that are most able to adapt for change that are most able to survive and thrive in the world,” Mowry added, quoting Charles Darwin.

The Need for Speed

Companies are already operating in a shifting marketplace, as NewSpace companies out of Silicon Valley are shaking up the market across the value chain by introducing new launch systems to compete with traditional space companies.

“In this emerging market we have to be very much market driven and part of that is that we have to be driven by speed to market to keep up with the emerging market,” said Jay Gibson, CEO and president of XCOR, a new business developing a spacecraft that will enable suborbital and then orbital business services.

Gibson sees platform reusability and flexibility driving this change and opening the door to faster speed to market. He expects adaptable platforms will, in turn, drive the business case for companies looking to find their way in the NewSpace landscape.

“When you get to reusability, you start to achieve what then brings us into a commercial environment, which is frequency and affordability. And when you do that you open up the market to all kinds of interesting things. You allow the market to drive who you are and what you do,” Gibson said.

Speed to market is impacting established launch companies as well, as they look to accommodate more rapid mission needs from startups and small satellite companies. This includes attempting to accommodate companies such as OneWeb, which is looking to launch 21 satellites in 18 months, according to Mowry.

“For the NewSpace companies [the business case for return on investment] is definitely on a shorter time line. If you’re talking about these guys who are able to produce those satellites rather quickly — not in a two to three year timeline to build a geostationary platform, but in 18 months, a year, or even less with CubeSats — these guys are looking at launch opportunities with my company much more quickly than we would typically … these guys are looking at much more compressed timelines and it’s something we need to adapt to,” said Mowry.

Accessing Affordability

To make the business case, space companies are also searching for ways to drive down the price point and introduce more affordable services, satellites and launches. Bandwidth providers are looking to up the capacity of a given satellite through High Throughput Satellite (HTS) systems and other advances to accommodate this change.

“It’s not just in the launch business where we need to be affordable, we need to be affordable on the platform side,” said Kay Sears, president of Intelsat General. “Affordability will drive new applications, especially applications like the Internet of Things (IoT), so the constellation that we are building right now that will launch over the next couple of years will target mobility and these new kinds of Internet of Things applications.”

The company’s EpicNG platform, launching in January, will have about 10 times the total throughput of its current satellites through the creation of a multi-spot pattern across the coverage. Instead of a widebeam satellite there are several smaller spot beams, which increase the downlink power to enable the use of smaller antennas. They also allow the company to reuse the spectrum so the total throughput of the satellite increases and the cost-per-bit goes down, according to Sears.

New manufacturing protocols may also open the door to more affordable systems, according to Eric Thoemmes, vice president of space and missile defense programs at Lockheed Martin.

“In the manufacturing world there is a dramatic revolution going on as to how we approach the design, development and production of space vehicles,” said Thoemmes who spoke to a concept in which the company uses digital design capabilities to curb issues that pop up as spacecraft move from concept to build.

“The digital tapestry is all about taking 3-D design capabilities, taking those all the way through engineering and directly into manufacturing. In the past we would have design; and those people would do drawings; and those would be passed on to manufacturing; and those in manufacturing would try to decide how to implement that; and, in many cases, spend a lot of time correcting problems that were not envisioned in the design phase. With digital design, you are able to walk yourself through the entire value chain all the way through the production and into operations, to some extent, of these satellites,” Thoemmes said.

Additive manufacturing, or 3-D printing, is also helping the company to bring componentry into the space domain that it could not have designed in the past. Lockheed Martin is using these ideas to modernize its A2100 spacecraft in the government domain as well as in the commercial market. A recent contract win, the Hellas-Sat 4/SaudiGeoSat 1, which will carry a flexible payload, will showcase these improvements. Thoemmes also pointed to a recent unselected proposal Lockheed Martin took part in, in which the company could design and build 50, 150-pound class Low Earth Orbit (LEO) small satellites per month at the cost of $500,000 per satellite through new digital design techniques.

Building Partnerships

Addressing all the needs of the current and future markets is no easy task, however, and by combining specialties in both space and ground components, the market can come to address the growing needs.

“Another symptom of the NewSpace business is that it’s all about partnerships,” said Sears, whose company, Intelsat, announced a partnership in June with OneWeb, a company planning to launch a LEO satellite constellation of more than 600 satellites, in an alliance that aims to make broadband more accessible to businesses and consumers, everywhere. “We’ll be developing terminals that will be able to work LEO and GEO at the same time. This is a whole new revolution as to how we are going to move data around.”

“[The NewSpace business] is changing so rapidly and expanding so rapidly, one company cannot address all these users on their own. So, you really need to partner and be creative in how you combine your networks and your capabilities,” Sears added.

Correction: Lockheed Marin took part in a recent unselected proposal in which the company competed for a 50 small satellite contract weighing 150 lbs per satellite at the cost of $500,000 each. We originally reported the cost of building a satellite as $500. We regret the error.

The post Space Business Leaders Look to the Future of the Satellite Market appeared first on Via Satellite.